Monthly Market Insight, April 2025

Introduction

One of the country’s most popular topics for discussion and a political vote-winner is “The Housing Market.” The problem is that there is no such thing. Instead, there are countless micro-markets: London, the countryside, flats, houses, detached, semi-detached, terraced – all moving in different directions at different times.

At GP Weston, we understand that the property market is not monolithic. Instead, we focus on hyper-local trends, particularly within South Somerset and North Dorset—our core areas of expertise. While we occasionally operate beyond these areas, this report is grounded in the regions we know best.

Scope and limitations

We also recognise the limitations of traditional indices. Most house price data, including that from the ONS, Nationwide, and Halifax, suffers from significant lag or limited coverage (e.g., excluding cash purchases or reporting only asking prices). A sale can take 2–4 months from offer to exchange, and an additional 3–6 months before appearing in the Land Registry data, meaning most price indices effectively report information 6–9 months out of date. Rather than focusing solely on house prices, our analysis tracks real-time market activity: the volume of new listings, sales agreed, and available stock. Combined with over 20 years of on-the-ground experience, this approach allows us to identify trends, anticipate market direction, and provide informed guidance to help clients achieve optimal results.

Like any analysis, we are limited by the quality of the data. While some properties are listed by multiple agents or agents manipulating the system by re-launching properties to make themselves seem busier,

we feel that the data set is big enough that these discrepancies are lost in the size of the pool and don’t impact the trends we observe.

Industry Overview

As touched on previously, there are many different indices, all quoting different results and measuring different things. Even using raw data from the property portals, without spending an unreasonable amount of time trying to clean the data, there will be double counts and false listings as agents try to make their “market share” look better to attract clients.

The main market reports quoted in the press are the Halifax and Nationwide house prices, the Office for National Statistics, and the property portals Rightmove and Zoopla.

Halifax and Nationwide report off the back of their respective mortgage applications, but do not consider cash purchases.

The House Price Index from the Office of National Statistics is based on actual prices paid as sales are registered with the Land Registry. There is a significant lag with this, though, because it takes 8-16 weeks for an offer to exchange and then another 3-6 months for the sale to be logged with the Land Registry. Thus, the HPI is reporting on what was happening in the market 6 to 9 months ago.

Lastly, Rightmove and Zoopla both issue market reports based on asking prices. The major flaw in these is that, firstly, very few properties sell at their asking prices, but more importantly, asking prices are invariably inflated by estate agents overeager to win the instruction, pandering to homeowners’ biased opinions. This happens more from December through to April/May as agents try to build a good register of properties to see them through the year.

Market Trends

If you watch the market for long enough, you notice that the long-term trend for the property market is 7-8 years up (with the odd dip or plateau) followed by 2-3 years down. Fundamentally, this is because approximately 1.0m to 1.2m people move home each year. Most home moves are driven by necessity, and people can only put their lives on hold for so long (2-3 years) before all the factors that made them think of moving in the first place become unbearable.

Inventory Growth & Buyer Behaviour

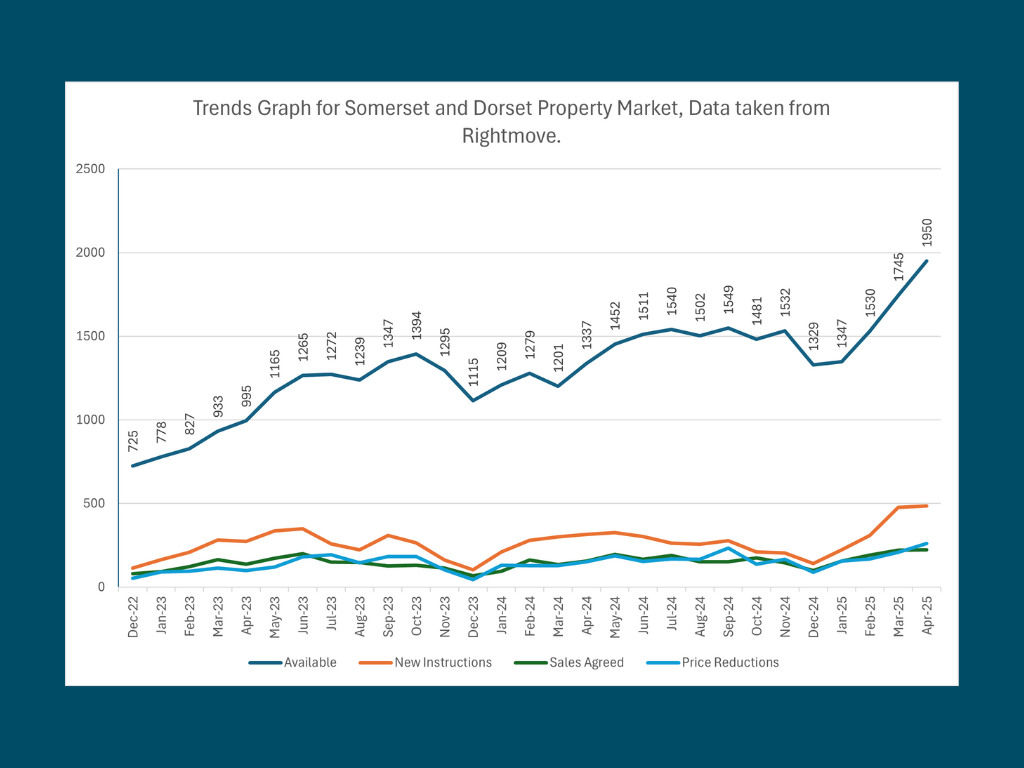

Since the end of the post-COVID boom and the “race for space,” the number of available properties has increased markedly—from 725 in December 2022 to over 1,900 in April 2025, representing a 171% rise. This supply growth is due to several factors: rising mortgage rates, increased taxation on second homes, and a return to office-based work, all of which have cooled buyer demand.

Sales agreed each month have remained consistent, aligning with the national average of 1.0–1.2 million annual home moves. However, the increasing supply has resulted in:

- Downward pressure on prices, as sellers compete more aggressively for buyer attention

- Longer time on market, as buyers have more choice and less urgency.

In this climate, accurate pricing, strong presentation, and proactive engagement are more important than ever.

Market Segmentation

We have said all along that we are less interested in nominal prices and more interested in demand and trends. The location dictates that the most common price points are between £200k and £500k. However, what we want to see is which price points have the greatest and weakest demand as measured by the percentage of properties either going under offer and/or being reduced in price.

With 17% of available properties being sold, the £200k to £300k price bracket appears to be most in demand, whilst at just 3%, the market over £2.0m is seeing the least activity. The market splits at the £500k mark, with the percentage of properties below that price point being agreed generally in double figures, and over £500k, it drops to single figures.

This pattern is likely expected with the tripling and quadrupling of interest rates on mortgage products from 2022 to the present. The higher the price point, the bigger the mortgage, and therefore the bigger the impact of rates going from below 2% to over 4%/5%. At lower price points, the increase in interest rates has a proportionately smaller effect.

As we saw with price points, geography also dictates that with the space afforded by rural living, there are not many one-bedroom properties. South Somerset and North Dorset are not constrained by congested urban spaces. Therefore, the majority of properties are three and 4-bed. Also, like the price points, the greatest demand is for these properties, with the percentage of properties with four or fewer, where statistics can sometimes raise anomalies with small sample sizes. Here we can see that one-bed properties are “most in demand” but in this case, we think it is just because there are only 22 available, so a mere three sales means that 14% of available one-bed properties went under offer.

Our third market breakdown was by property type. As one would expect from the previous two breakdowns, the space afforded by rural living means detached properties are the most common. What is more specific to South Somerset and North Dorset is that these two counties have the oldest average age meaning that bungalows are popular due to the accessibility provided by being on one level.

Again, the data is slightly skewed by the small number of flats, but one would expect that detached houses would be the most in demand. In our opinion, the lower price points of terraced houses minimise the extra cost of mortgages these days, thereby meaning that more of these are selling than detached homes through necessity rather than choice.

Conclusion

For the past 10 years, I have done a very similar report but on a more general basis. This is the first time I have broken the market down into property types, price brackets, and the number of bedrooms. For the sake of brevity and keeping the audience engaged, I have stopped here, but it is obviously possible to dig deeper. If anyone would like to discuss their property in more depth, I would, of course, be delighted to meet in person and go through the numbers.

Looking at the market as a whole, the headline figures show a 170% increase in available properties and an average of 11% of available properties going under offer. If you want to sell, then your property needs to stand out. Now that could mean standing out in terms of what it has to offer, bedrooms, land, condition, etc., but if it has nothing to make it stand out in those ways, then it will need to stand out in terms of price. Gone are the days of multiple buyers scrapping over every property the day it is launched.

It is well known in property circles that if you launch a property at a price that is too high and subsequently has to be reduced, it takes longer to sell and will eventually sell at a lower level than if it had been launched correctly at the start. This is for two reasons: 1) it could be following the market down, and therefore, for every day it is on the market, it is worth less and less. or 2) it is just consumer behaviour that if the property has a “reduced” label next to it on the various websites, then buyers worry there is something with it and offer cautiously.

If you would like to speak to us about selling your home we would be delighted to give you the benefit of our experience. You can call James on 07525 008 650 and Jessica on 07875 355 382, or email in at team@gpweston.co.uk.

Yours

James Weston